www tax ny gov online star program

Senior citizens meeting specific income criteria are eligible for Enhanced STAR. The STAR Program provides school district property tax relief to all residential property owners and enhanced property tax relief to income eligible senior citizens age 65 or older.

Receiver Of Taxes Town Of Oyster Bay

- scrolls down to website information.

. STAR Check Delivery Schedule. This application is for owners who had a STAR exemption on the same property in the 20152016 tax year and wish to apply for Enhanced STAR. Enhanced STAR is for homeowners 65 and older.

There are two types of STAR benefits depending on household income. New York State recently altered the STAR program lowering the maximum income limit for the Basic STAR tax exemption to 250000. Below you can find a guide to frequently asked questions about the program.

If you are using a screen reading program. All other primary-residence homeowners in Nassau are eligible for Basic STAR. E-file directly to the IRS.

Beginning in 2016 any homeowner who is applying for the first time on a property meaning you have NEVER had any STAR exemptions on your property before or you are a new homeowner of a property is required to register with New York State Department of Taxation and Finance. Parts to the STAR property tax exemption Enhanced STAR and Basic STAR. Do it for free.

There have been some changes in how certain homeowners will apply for STAR and in how they receive their STAR benefit. The School Tax Relief STAR Program FAQ Updated 2021 The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners. Enter the security code displayed below and then select Continue.

Basic STAR is for homeowners whose total household income is 500000 or less. Homeowners not currently receiving STAR who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and Finance. External web sites operate at the direction of their respective owners who should be contacted directly with questions regarding the content of these sites.

Ad Download Or Email NY RP-425 More Fillable Forms Register and Subscribe Now. The STAR program provides an exemption from school property taxes for owner-occupied primary residences and certain mixed-use properties. Enter the security code displayed below and then select Continue.

ENHANCE STAR is for homeowners age 65 and older with incomes of 86300 or less. Your benefit may increase by as much as 2 each year. The following security code is necessary to prevent unauthorized use of this web site.

The benefit is estimated to be a 293 tax reduction. If you have further questions about STAR contact your New York State Senator or call the STAR helpline at 518-457-2036 from. Receive your STAR check directly from New York State.

STAR helps lower property taxes for eligible homeowners who live in New York State school districts. New applicants who qualify for STAR will register with New York State instead of. The Enhances STAR Exemption will provide an average school property tax reduction of at least 45 annually for seniors living in median-priced homes.

All New Yorkers who own or have life use and live in their. The State of New York does not imply approval of the listed destinations warrant the accuracy of any information set out in those destinations or endorse any opinions expressed therein. The STAR program continues to provide much-needed property tax relief to New York States homeowners.

Due date for all applications is June 1st. The STAR program is the New York State School Tax Relief Program that provides an exemption from school property taxes for owner-occupied primary residences. The following security code is necessary to prevent unauthorized use of this web site.

Ad No Money To Pay IRS Back Tax. Only available to homeowners who have been receiving the STAR exemption on their same primary residence since 2015 and appears as as a reduction on the school tax bill. STAR is New York States School Tax Relief Program that provides tax exemptions to.

This State-financed exemption is authorized by Section 425 of the Real Property Tax Law. Basic STAR Exemption and Star ENHANCED Exemption. STAR exemption to register with the Tax Department in order to receive the exemption in 2014 and beyond Program applies to more than 26 million Basic STAR recipients Senior citizens receiving Enhanced STAR exemption are not impacted by this legislation All property owner questions should be directed to DTF at 518 457-2036 2.

If you are using a screen reading program. The Village of Freeport has no role in administering this program. STAR property tax relief program Whats New.

FreeTaxUSA FREE Tax Filing Online Return Preparation E-file Income Taxes. Beginning with the October 20192020 school tax bill the state will automatically switch current Basic STAR tax exemption participants with a household income greater than 250000 and less than or equal to 500000. This is a state-financed exemption.

New for 2019 If you are receiving the Enhance STAR exemption but are not enrolled in the Income Verification Program you must renew your application and fill out a seperate form for IVP. Home are eligible for the STAR exemption on their primary residence. The School Tax Relief STAR and Enhanced School Tax Relief E-STAR benefits offer property tax relief to eligible New York State homeowners.

We changed the login link for Online Services. Who Can Apply Homeowners not currently receiving the STAR exemption who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and. Visit wwwtaxnygovonline and select Log in to access your account.

Federal 0 State 1499. We recommend you replace any bookmarks to this.

Launch Of India S First And Only Income Tax Case Research Tool Having Free Subscription Giving Access To A Repos Government Website Web Research Corporate Law

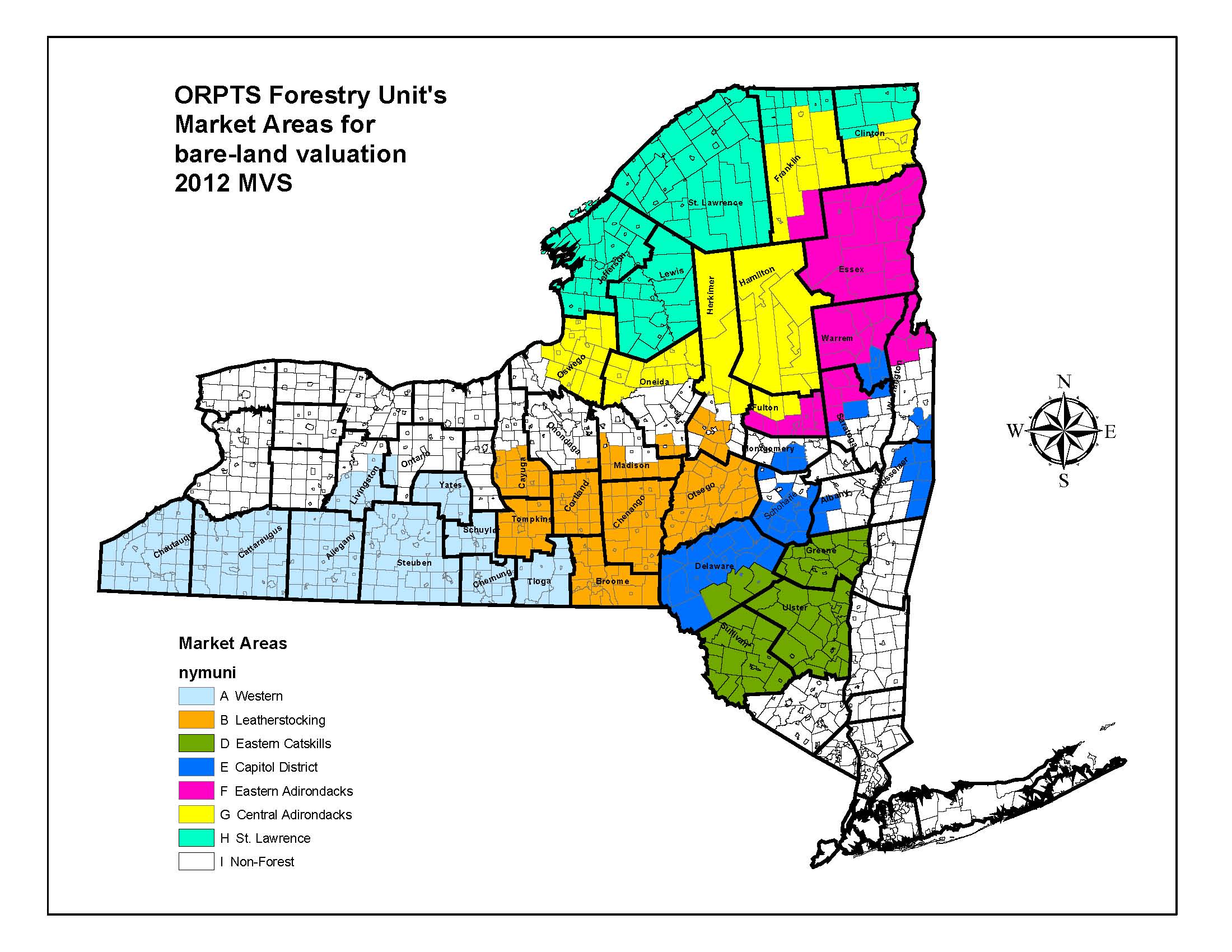

Forestry S Bare Land Valuation Map

The School Tax Relief Star Program Faq Ny State Senate

Ridiculous Password Policies Are A Constant Frustration To Users And Security Professionals Alike They Aren T Making Us Mor Passwords Policies Create Password

New York Fdny Fire Engine 205 Ladder 118 New York Patchgallery Com Online Virtual Patch Collection By 911patches Com Fir Ems Ambulance Fdny Fire Badge

Managing Your Inventory Inventory Management Techniques That Keep You From Losing Money Clickfunnels Management Techniques Inventory Management Software Inventory Management

Chart The Downward Spiral In Interest Rates During The Onset Of An Economic Crisis National Governments Interest Rate Chart Interest Rates Financial Wealth

Find 990 Series Forms And Annual Filing Requirements For Tax Exempt Organizations Private Foundation Internal Revenue Service Filing Taxes

Professional Indemnity Insurance Explained Infographic Indemnity Insurance Professional Indemnity Insurance Indemnity

Blank Resume Template With Cv Simply You Dont Need To Use Those Sophisticated Design Softwares To Create A Perfect Cv O Cv Template Download Cv Template Resume

A Frozen Bank Account Is A Bank Account That You Cannot Access Because A Creditor Has Placed A Restraint On Credit Card Online Student Information Bank Account